Catastrophe risk modeller RMS has estimated that insured losses driven by Hurricane Dorian in the US, Canada and the Caribbean will total between US $4 billion and $8.5 billion.

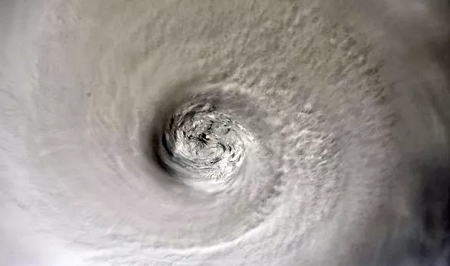

Source: NASA

The firm previously released an industry loss estimate of between $3.5 billion and $6.5 billion for the impact of Dorian in the Caribbean, with the vast majority of damages to come from the Bahamas.

Now, RMS has said it believes insured losses in the US will be between $500 million and $1.5 billion, while losses in Canada should be below $500 million.

The loss estimate for the US represents losses associated with wind and storm surge damage, including losses to the National Flood Insurance Program.

It also reflects property damage and business interruption to residential, commercial, industrial, and automobile lines of business. RMS added that post-event loss amplification and inland flooding caused by rain are not expected to contribute significantly to overall losses.

Prior to this, the only catastrophe modelling firm to have released an estimate for the total expected industry loss from Dorian was Karen Clark & Company (KCC), who put the total cost at $5.2 billion.

This reflected a $3.6 billion loss estimate in the Caribbean and a $1.5 billion loss in the US, as well as losses of $23 million in Puerto Rico and $84 million in the US Virgin Islands.

While KCC’s overall estimate is significantly lower than RMS, its figure for the US is at the upper range of the RMS estimate, and losses from Canada are not included.

AIR Worldwide also came out with a more conservative estimate for the Caribbean recently, putting industry losses at between $1.5 billion and $3 billion.

Similarly, experts from rating agencies and major reinsurers at the Reinsurance Rendezvous event in Monte Carlo last week seemed to agree that the total industry impact of Dorian would be less than $10 billion.

Hurricane Dorian was the fourth named storm of the 2019 North Atlantic hurricane season and the first major hurricane of the season.

It made landfall on September 1 on the Abaco Islands in the Bahamas as a Category 5 hurricane with maximum sustained wind speeds of up to 185 mph, before stalling over the northern Bahamas for more than 36 hours.

This makes Dorian by far the strongest hurricane to have ever made landfall in the Bahamas, and reports suggest there has been widespread devastation in the region.

The International Red Cross believes that 45% of the homes on Grand Bahama and the Abacos Islands have been severely damaged or destroyed, representing some 13,000 properties.

Dorian later made landfall in the US on September 6 over Cape Hatteras, North Carolina as a Category 1 hurricane and impacted Nova Scotia, Canada later in the week with hurricane-force winds.

“While Dorian caused material damage in several states, the overall impact to the U.S. could have been much worse had the storm taken a different track,” said Jeff Waters, Senior Product Manager for RMS North Atlantic Hurricane Models.

“We were fortunate that the majority of Dorian’s damaging winds and storm surge remained offshore as it tracked along the U.S. coastline, before weakening, and eventually making landfall in North Carolina.”

However, RMS also warned that insured losses are likely to constitute only a fraction of the economic cost of Hurricane Dorian, particularly in the Caribbean, which has a lower rate of insurance take-up than the US.