Reinsurance News

Reinsurance broking news

Reinsurance broker news, analysis and insight, covering reinsurance broker market trends and opportunities.

Reinsurance brokers have a core role to play in the market, so we frequently cover news related to their activities and also interview senior reinsurance broking executives as well.

Acrisure Re enters broking partnership with LEUE & NILL

1st August 2022

Acrisure Re, the reinsurance division of global insurance broker and fintech platform, Acrisure, has entered into a strategic broking partnership with German broker, LEUE & NILL, effective immediately. One of the largest insurance brokers in Germany with more than 500 employees, LEUE & NILL provides a full range of insurance services ... Read the full article

Howden agrees to acquire French firm CRF

29th July 2022

Insurance and reinsurance broker Howden has signed an agreement to acquire broker firm CRF. The firm said in a statement that this was its first acquisition in France since appointing Nicolas Aubert as CEO of Howden France. CRF was founded in 1999 and focuses on financial lines. Aubert said in a statement: ... Read the full article

Aon’s Reinsurance Solutions delivers organic revenue growth of 9% in Q2

29th July 2022

Insurance and reinsurance broker Aon has announced total organic revenue growth of 8% to $3 billion in the second-quarter of 2022, on the back of growth in all business segments including a notable 9% rise in organic revenue within its Reinsurance Solutions arm. Across the firm, Aon has revealed that net ... Read the full article

WTW posts 3% organic growth, maintains full-year targets

28th July 2022

Re/insurance broker WTW has posted 3% organic revenue growth for the second quarter of 2022, despite total revenues declining by 3% to $2.03 billion. After posting 2% organic growth in Q1, the broker seems to remain slightly below its target of “mid-single digit” organic revenue growth for the full year, ... Read the full article

Acrisure Re hires Chuck Furlong as senior vice president and broker

27th July 2022

Acrisure Re, the reinsurance division of Acrisure, has appointed Chuck Furlong as senior vice president and broker. Furlong will focus on expanding Acrisure Re’s reinsurance capabilities in property and casualty in North America. He most recently served at Guy Carpenter, where he was head of US casualty facultative reinsurance. Read the full article

US property cat reinsurance rates up by 15% in 2022: Guy Carpenter

25th July 2022

So far this year, property catastrophe reinsurance rates-on-line in the U.S. have risen by almost 15%, representing the largest increase in the Guy Carpenter U.S. Property Catastrophe Rate on Line Index since 2006. Reinsurance broker Guy Carpenter's index is a proprietary index of U.S. property catastrophe reinsurance rate-on-line movements, so ... Read the full article

H1 2022 “most challenging property market for years” – Klisura, Guy Carpenter

25th July 2022

The first half of 2022 was “the most challenging property market we have seen in a number of years”, according to Dean Klisura, President and Chief Executive Officer of Guy Carpenter. Speaking during Marsh McLennan’s Q2 2022 earnings call, he said that US property catastrophe rates have ... Read the full article

BMS Re acquires reinsurance broker Calomex

25th July 2022

BMS Re, the reinsurance arm of the independent specialist broker, has acquired reinsurance broker firm Calomex for an undisclosed amount. A statement from BMS said that it would acquire Calomex in full with Jorge Bellot, president of the latter, reporting to Aidan Pope, executive chair and CEO of BMS Re LAC. Pope ... Read the full article

Flood risk routinely underestimated, warns MMC

22nd July 2022

Re/insurance broker Marsh McLennan has released its updated Flood Risk Index 2.0, which maps how a changing climate will shape flood risk in the future. The report warns that flooding is the most pervasive natural disaster, and yet its costs are routinely underestimated. And now, climate change, economic and demographic trends, and ... Read the full article

WTW makes series of appointments within its NA Natural Resources business

22nd July 2022

WTW has made a significant investment towards its North American Natural Resources business, as the re/insurance broker has appointed five new industry leaders to bolster the existing North American team. Based in Houston, the new team members will bring expertise to focus on this globally important industry, with a sub-sector focus ... Read the full article

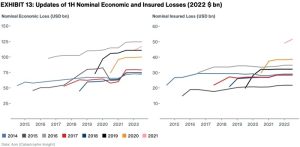

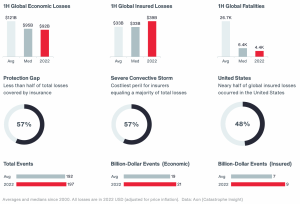

Inflation to magnify H1 insured losses, says Aon

22nd July 2022

Analysts at Aon have warned that inflation, in combination with other factors, are likely to magnify insured losses in the first half of 2022 beyond initial estimates. The broker's data shows that insured losses from natural disaster events totalled $39 billion in H1, which is roughly 18% above the 21st ... Read the full article

Miller appoints Paul Jacobs and Steve Quick to new Rural team

22nd July 2022

Independent specialist re/insurance broker Miller has announced its expansion into the farms and estates insurance business with the appointment of Paul Jacobs and Steve Quick to form a Rural team. The Rural team will be part of Miller’s new ‘International Special Asset Insurance’ department, which incorporates its Private Client, Rural and ... Read the full article

Guy Carpenter sees 9% revenue growth in Q2 as Marsh McLennan reports ‘another strong quarter’

21st July 2022

Consolidated revenue at Marsh McLennan increased by 7% in the second-quarter of 2022 when compared with the previous year, supported by strong growth across the business, including at Guy Carpenter, the reinsurance arm of the global brokerage. Overall, insurance and reinsurance broker Marsh McLennan has reported revenue of $5.4 billion for ... Read the full article

UK car insurance premiums increase by 6%, industry facing a “raft of challenges”: WTW

21st July 2022

Comprehensive car insurance premiums have increased by 6% (£32) during the last 12 months, with UK motorists now paying £554 on average, according to data from WTW and Confused.com Car Insurance Price Index. WTW recently warned that UK motor claims inflation was on the rise, as the broker recently revealed ... Read the full article

Global insured losses from catastrophes above average at $39bn in H1 2022: Aon

20th July 2022

Data from insurance and reinsurance broker Aon finds that globally, insured losses from natural disaster events totalled $39 billion in the first half of 2022, which is roughly 18% above the 21st Century average. In contrast to the above average volume of catastrophe losses experienced in the six-month period, global economic ... Read the full article