Reinsurance News

Brexit news

Brexit news of relevance to the insurance and reinsurance market.

Brexit has ramifications for UK and London market insurance and reinsurance firms access to the EU and vice versa.

UK Gov to review Solvency II ahead of Brexit transition deadline

25th June 2020

The United Kingdom’s HM Treasury has announced that it plans to review Solvency II rules for insurers and reinsurers ahead of the Brexit transition end on 31 December 2020. The government said that the review would ensure that Solvency II is “properly tailored” to take account of the structural features of ... Read the full article

Lloyd’s Part VII transfer progresses after High Court strategy approval

26th May 2020

The specialist Lloyd's of London re/insurance marketplace has received approval from the High Court of England and Wales for its Part VII strategy for notifying policyholders about the proposed transfer of its existing European business to Lloyd's Brussels. Lloyd's announced in March of 2017 that it had selected Brussels as ... Read the full article

UK / EU reinsurance equivalence not guaranteed: Lloyd’s Chairman

26th February 2020

Lloyd’s of London Chairman Bruce Carnegie-Brown has warned that it would be “extraordinary but perhaps not entirely surprising” for the UK to lose reinsurance regulatory equivalence with the European Union (EU) after Brexit. Addressing the EU Financial Affairs Sub-Committee today, Carnegie Brown said that a loss of equivalence could pose a ... Read the full article

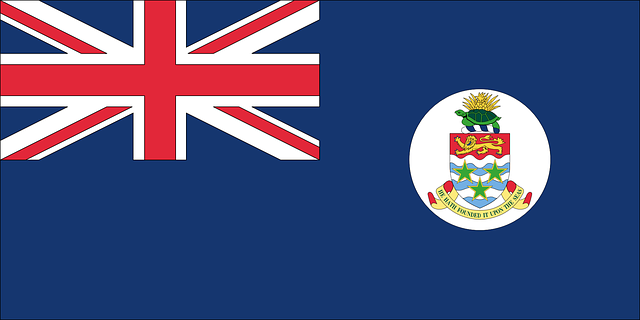

Cayman Islands to join EU tax blacklist as UK loses sway

17th February 2020

The Cayman Islands is set to be blacklisted by the European Union (EU) for failing to comply with good governance standards on tax, according to reports from the Guardian. The decision regarding the British overseas territory comes just two weeks on from the UK’s official departure from the EU, and may ... Read the full article

LMA sets Future at Lloyd’s & Brexit as key objectives for 2020

10th February 2020

The Lloyd’s Market Association (LMA) has revealed its objectives for 2020, which include a focus on the Future at Lloyd’s reforms and Brexit planning. Engaging with Lloyd’s on the delivery of its new strategy is the primary objective for the LMA this year, and is expected to underpin the Association’s priorities ... Read the full article

AM Best’s post-Brexit arrangements will apply irrespective of EU trade deal

3rd February 2020

A.M. Best has said that measures it has implemented to prepare for a post-Brexit environment will apply irrespective of the UK's ability to reach a trade with the European Union (EU) by December 2020. Like many other global organisations within the UK financial services sector, ratings agency A.M. Best has taken ... Read the full article

UK re/insurers prepared for Brexit, but long-term effects uncertain: AM Best

31st January 2020

With the UK set to imminently depart the European Union (EU), AM Best has said UK re/insurers are well prepared from an operational standpoint, but could face some negative consequences in the longer-term. The rating agency noted that extensive preparations have been undertaken across the UK and European markets to ensure ... Read the full article

LIIBA agenda spotlights Lloyd’s reforms & Brexit planning

27th January 2020

The London and International Insurance Brokers’ Association (LIIBA) has announced the publication of its agenda for 2020, which emphasises further participation in the Future at Lloyd’s program and efforts to support Brexit planning. Specific initiatives for the year include working with HM Treasury to explore options for a regulatory approach more ... Read the full article

UK election result offers insurers increased certainty: Clyde & Co’s Newman

16th December 2019

Despite much work still needing to be done around the UK's Brexit vote and future trade relationships, the result of the general election last week, which saw the Conservatives win an overall majority, delivers a greater level of certainty for insurers than what the sector has been used to over ... Read the full article

Malta could become alternative to the UK after Brexit: finance leaders

6th November 2019

Malta could develop into an alternative base for UK re/insurers after Brexit, according to leading figures from financial and re/insurance industry bodies in Malta. Speaking at a recent roundtable in London, Matthew Bianchi, Governor of FinanceMalta, said expected the jurisdiction to evolve into an attractive option for re/insurers looking to retain ... Read the full article

EU market access prompts Aon to move parent incorporation to Ireland

29th October 2019

As a result of Brexit and a subsequent desire to remain within the European Union (EU) single market, global insurance and reinsurance broker, Aon, has filed a preliminary proxy statement to move the jurisdiction of incorporation for the firm's parent company from the UK to Ireland. According to Aon, "Remaining within ... Read the full article

Insurers’ post-Brexit European branches generate more business in 2018: IUA

10th October 2019

As London market participants continue to prepare for the uncertain impacts of Brexit, the amount of new business being generated through established European branches and the volume of controlled business written in Europe (excluding the UK and Ireland), increased by more than 9% to £4.89 billion in 2018, reports the ... Read the full article

Everest Insurance Ireland’s UK branch now fully operational

3rd October 2019

Everest Insurance (Ireland), DAC (EIID) has revealed that its UK branch is now fully operational and has the ability to write a variety of business lines. Established in 2017, EIID enables insurer and reinsurer Everest to continue operating throughout the EU post-Brexit, providing its clients with continuity. In April of this year, ... Read the full article

GCube sets up post-Brexit hub in Amsterdam, names senior underwriters

25th September 2019

Specialist renewable energy insurer GCube has bolstered its European presence with the establishment of a new base in Amsterdam, which will serve as a hub to service clients following the UK’s exit from the European Union (EU). At the same time, GCube has appointed Andries Veldstra and Elkhadir El Hammdaoui as ... Read the full article

London may lose £61bn of re/insurance business due to Brexit, reports suggest

2nd September 2019

London may lose as much as £61 billion of insurance business as a result of the UK’s decision to leave the European Union (EU), according to reports from Bloomberg. The publication noted that huge amounts of business are being shifted over to rival financial centres on the continent, which will continue ... Read the full article